Business start-up assistance programs for foreign and foreign-affiliated companies

Support programs are available under certain conditions for foreign and foreign-affiliated companies that are newly established or relocating from outside the prefecture and that have been certified by the prefecture.

1. Subsidy for office rent

| Object | A subsidy is available for the cost of renting office buildings and other facilities. |

| Subsidy ratio | Up to 1/2 of the total cost (1/4 each from the prefecture and the city) |

| Max. amount | 2,000,000 yen/year, 1,500 yen/m²/month (1,000,000 yen/year each from the prefecture and the city; 750 yen/m²/month) |

| Subsidy period | Up to 3 years |

*Office rent subsidies from the prefecture are provided in addition to office rent subsidies from the city/town.

* In some cities and towns, additional subsidies may be available if separate requirements are met.

2. Subsidy for market research expenses

| Object | A subsidy is available for market research costs, etc. |

| Subsidy ratio | Up to 1/2 of the total cost *Reporting to the prefecture is required within 6 months of completion of the market survey. |

| Max. amount | 1,000,000 yen/company *If you are interested in Hyogo Prefecture as a potential site, please contact us first. |

3. Subsidy for corporate registration expenses

| Object | A subsidy is available for the cost of registration and residency status. |

| Subsidy ratio | Up to 1/2 of the total cost |

| Max. amount | 200,000 yen/company |

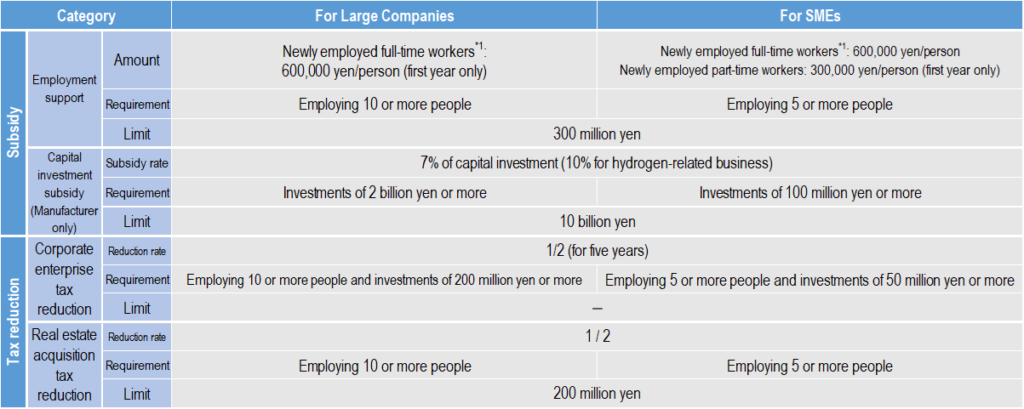

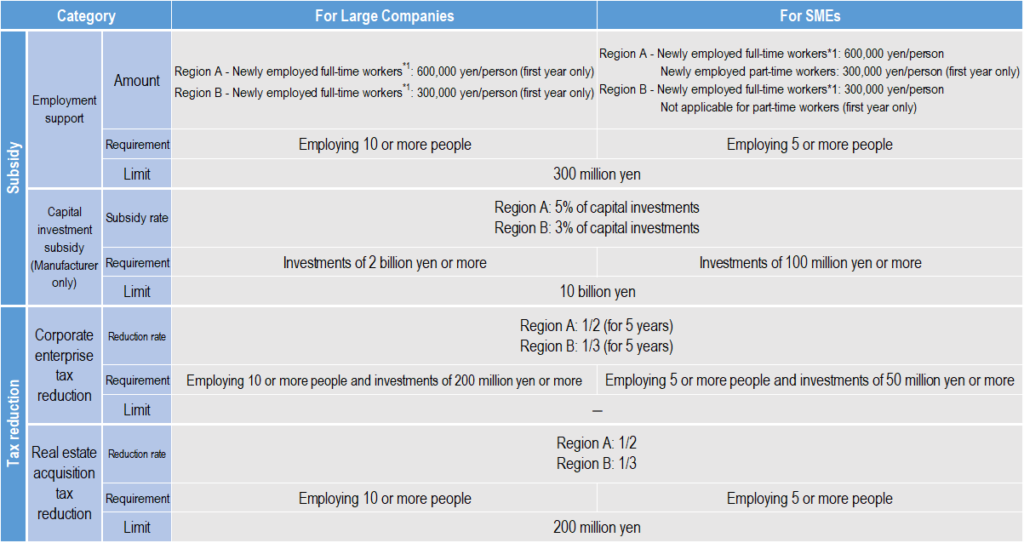

4. List of subsidies and tax reductions under the Ordinance Concerning Invigoration of Economy and Employment through Promotion of Business Establishment

1. Support priority industries (throughout the prefecture)

(1) New energy/environment (2) Aviation (3) Robotics (4) Health and medicine (5) Semiconductor

2. Other industries (Details of subsidies/reductions differ depending on regional category A and B)

*1 Newly employed full-time workers are those who are newly hired or transferred from outside the prefecture after the date of confirmation of applicable business, directly employedand covered by unemployment insurance, and continuously employed without a fixed term and have a certificate of residence in the prefecture.

*2 Region A (Investment Promotion Region)

Bay Area Region: Kobe, Amagasaki, Nishinomiya, Ashiya, Itami, Takarazuka, Akashi, Kakogawa, Takasago, Inami, Harima, Miki, Himeji, Sumoto, Minamiawaji, Awaji

Nature-rich Residential Areas: Nishiwaki, Taka, Kamikawa, Ako, Tatsuno (Shingu Town), Shiso, Kamigori, Sayo, Toyooka, Yabu, Asago, Kami, Shin’onsen, Tamba Sasayama, Tamba

Region B

Regions other than Region A above

〇 Foreign and foreign-affiliated companies

| Foreign company | A company registered outside Japan under foreign decree |

| Foreign-affiliated company | A company registered in Japan under Japanese decree, and whose issued stock is owned by, or which has received contributions from, a foreign company in excess of one-third of its total value |

〇 Designated Priority Business

A business that contributes to the invigoration of Hyogo’s economy and the creation of new employment, and that (i) utilizes high technology or (ii) contributes to the creation of comfortable and high-quality life for citizens or to the promotion of international economic exchange